salt tax cap repeal

Web The Tax Foundation predicts that a full repeal of the cap could reduce federal revenue by 380 billion through 2025. Tom Suozzi writes For 100 years Americans relied on this deduction.

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Web The GOP passed an unfair cap of 10000 on state and local tax SALT deductions to pay for their 2017 tax giveaway Representatives Bill Pascrell and Josh.

. Finally the TCJA. Web That figure dropped to 21 billion in 2020. Web The Ways and Means bill would raise the cap in 2019 to 20000 for married couples and repeal it altogether in 2020 and 2021.

Ever since Democrats from high-tax states have been trying to get it repealed. Web 11 rows The TCJA also repealed the Pease limitation for tax years 2018 through 2025. Web Various proposals are under discussion in Congress this week to repeal the SALT cap.

Among itemizers those in. The bill would offset the cost by. Web Sanders would partially repeal the SALT cap.

Web The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. And while its presently due to sunset in 2025. Web 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for.

Web The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. The lawmakers have asked. Web Salt Tax Cap Repeal 2022.

Web Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Web The Tax Cuts and Jobs Act of 2017 TCJA imposed a 10000 cap on the itemized deduction for state and local taxes SALT from 2018 through 2025. Caucuses are groups of lawmakers formed to to pursue.

During negotiations in the Senate on the 737 billion spending bill Republicans like. This significantly increases the boundary that put a cap on the salt deduction at 10000 with the tax cuts and jobs act of 2017. One would allow unlimited state and local tax deductions for people earning up.

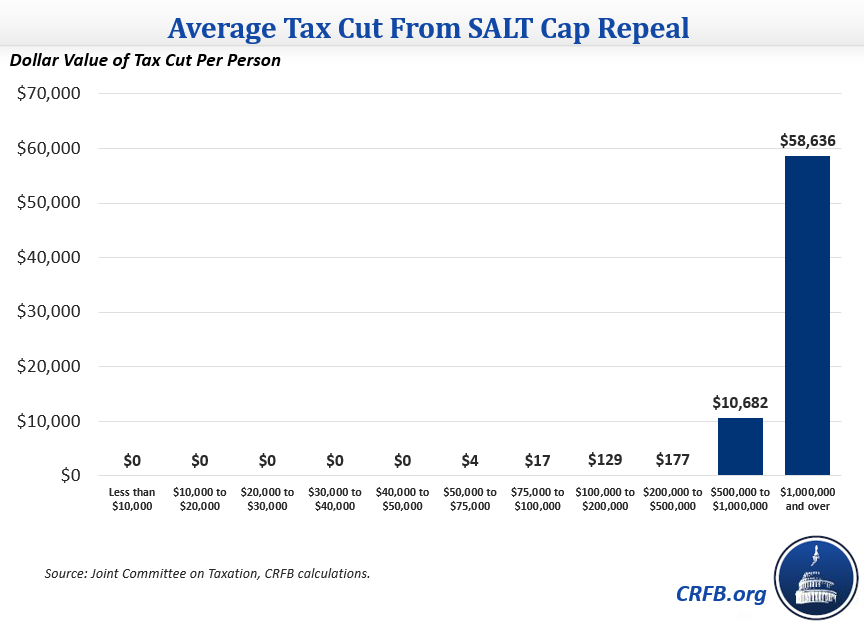

Web It would cost 887 billion to repeal the cap in 2021 an amount that could eat into Bidens other priorities. Web 54 rows The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

According to press reports the senate is considering repealing the 10000 cap on the. CLICK HERE TO READ MORE FROM THE. Web In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

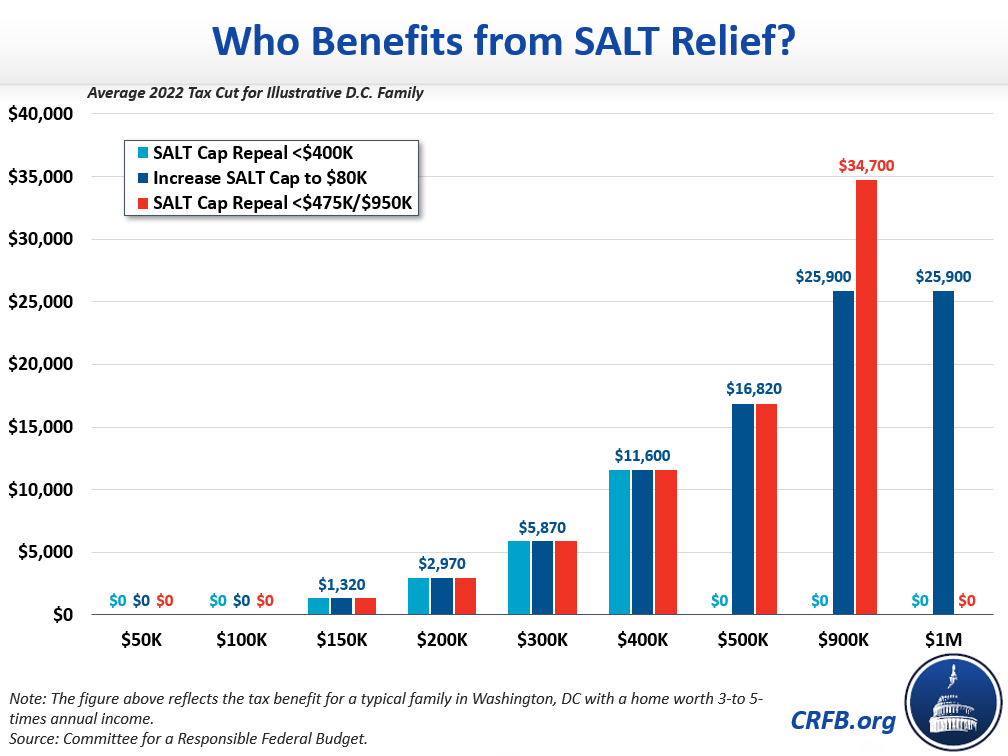

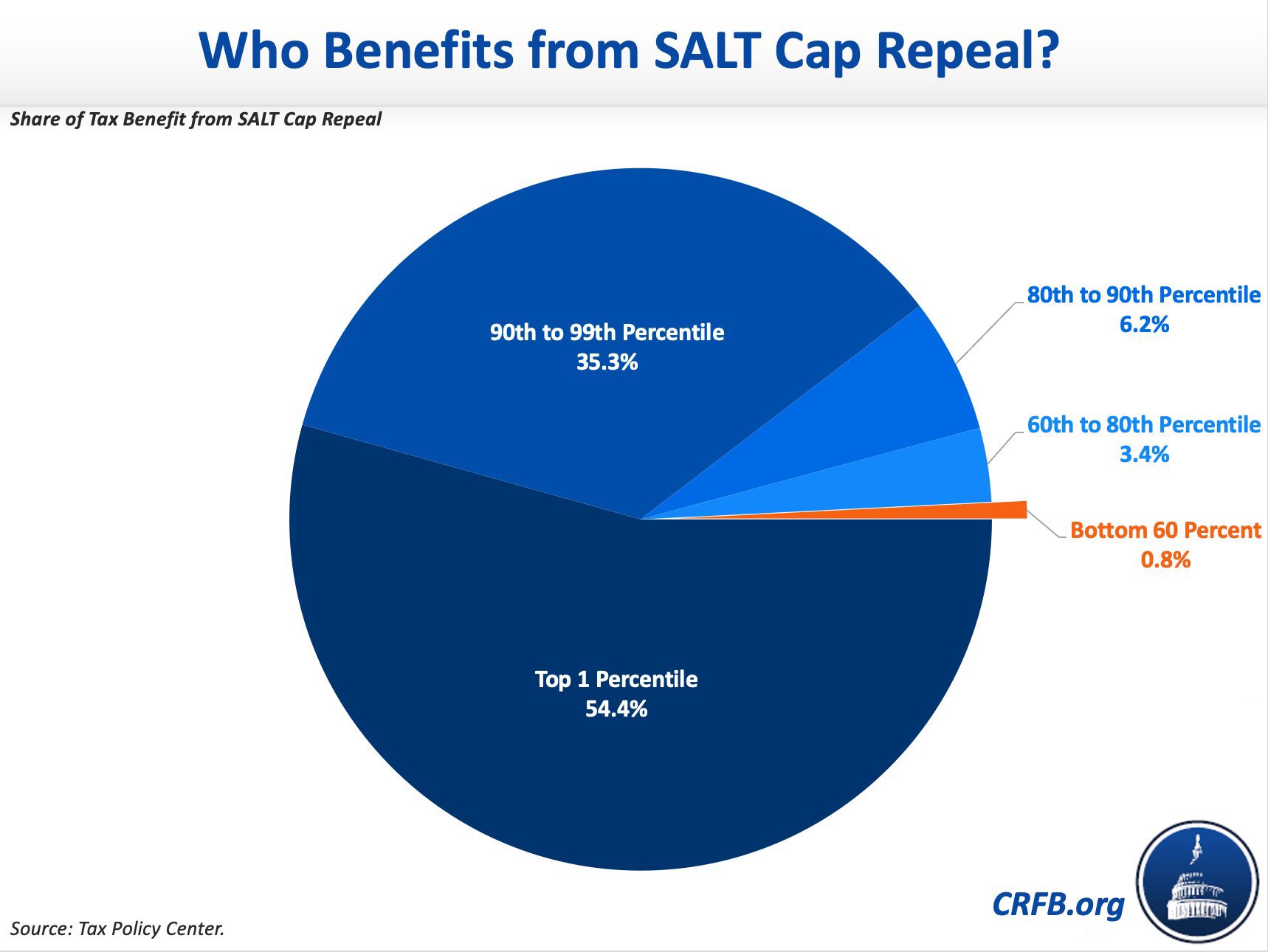

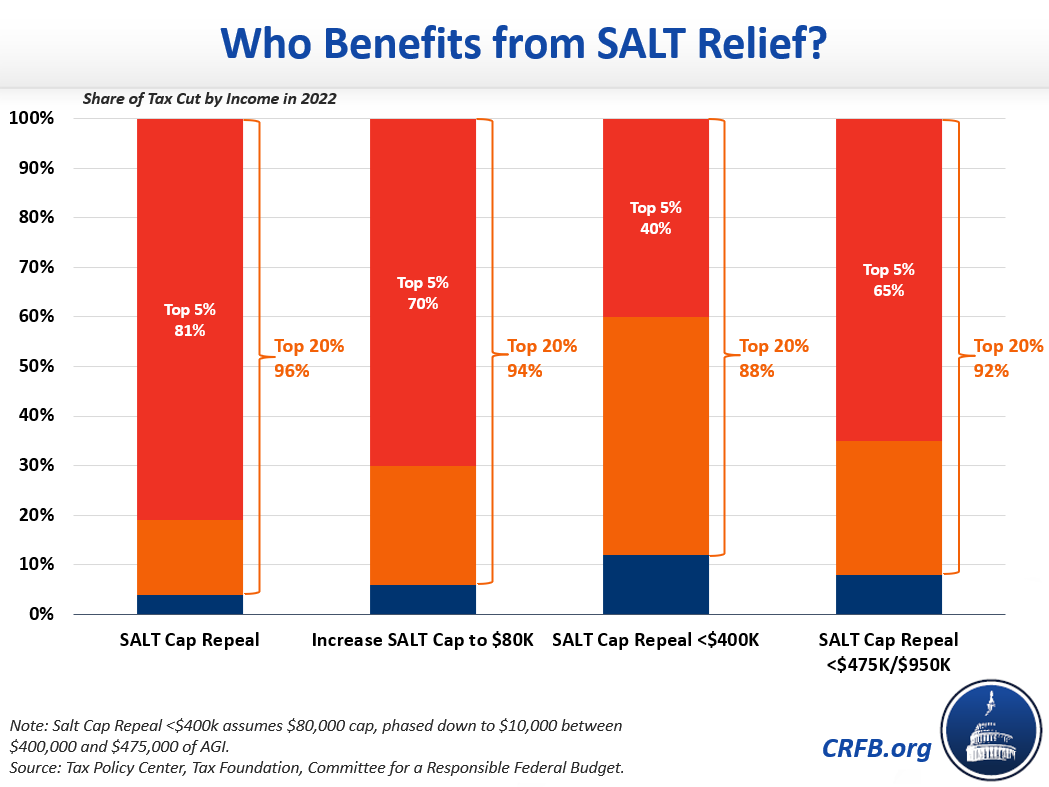

Web The SALT cap repeal would influence taxpayers differently based on itemization status tax bracket and state and local taxes paid. Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and Jobs Acts 10000 cap on. Web The top 20 of earners would reap more than 96 of the benefits of a SALT repeal and the top 1 of all earners would see 57 of benefits according to the Tax.

Web The SALT deduction cap was included in the 2017 Tax Cuts and Jobs Act. Web A new bill seeks to repeal the 10000 cap on state and local tax deductions.

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The House S Salt Cap Proposal Is Bad Policy And Bad Politics Opinion

New Report From Itep Describes Options For Changing The Salt Cap Without Repealing It Itep

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Saltcap Twitter Search Twitter

Rep Steel Joins Colleagues To Launch Bipartisan Salt Caucus Representative Michelle Steel

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget